Home

LifeBank - A Rural Bank

Your Partner for Life

More Than Banking, Building Dreams

LifeBank - A Rural Bank

Your Partner for Life

More Than Banking, Building Dreams

Gives Back To Your Community.

Empowering Filipino Farmers,

Building a Stronger Future.

LifeBank - A Rural Bank

Your Partner for Life

More Than Banking, Building Dreams

Memberships

Message from the CEO

Grow, Manage & Simplify: Your All-in-One Banking Suite

Start Saving Simply and Securely with LifeSaver

LifeSaver, also known as a Regular Savings Deposit, is the perfect way to kick-off your savings journey.

LifeSaver Plus:

Grow your savings faster

LifeSaver Plus – a “Special Savings Deposit” A deposit account with high-interest rate, fixed term, and easy monitoring to keep track of transactions and balance in a glance.

Teach Your Child Valuable Savings Habits Early On

LifeKiddie Savers is a fun and easy way to introduce your child (ages 7 to 12) to the world of saving!

The Passbook Account Designed for Teens

LifeTEEN empowers you (ages 13 to 19) to take control of your finances with a fun and easy-to-use passbook account. It’s the perfect stepping stone to financial independence!

ECPay at LifeBank: Pay Bills & Reload with Ease

Effortlessly manage your bills with ECPay’s wide network for utilities, telco, and internet. Enjoy fast and secure transactions anytime, anywhere.

Frequently Asked Questions (FAQs)

LIFESAVER – Regular Savings

You will only need an initial deposit of P500.00 for your new regular savings account.

Maintaining balance for a passbook account is P500.00 and a service fee of P200.00 will be charged to your account if you fall below the maintaining balance.

Interest on your savings deposit is computed daily and compounded quarterly, meaning interest net of withholding tax will be reflected in your account every end of the quarter.

LIFESAVER PLUS – Special Savings

Minimum deposit required to open a special savings account is P5, 000.00

Instead of a certificate, you will be issued a passbook, wherein it will be easier for you to monitor your account.

The only difference between a special savings account and a time deposit account is that you are given a passbook instead of a certificate of time deposit, the rest of the components is the same as a term and maturity date and of course a higher interest rate compared to a regular deposit.

There is an option for you upon account opening to have your account automatically renew every maturity, you just have to sign the automatic renewal agreement which our friendly staff will gladly assist you. That way, you don’t have to visit the branch every maturity date of your account.

If you opt not to sign the automatic renewal agreement, upon maturity date if you are not able to renew your account, it will still earn interest but the interest rate is the prevailing rate for regular savings deposit only.

You are allowed to top-up (add) or even partially/full withdraw your special savings account anytime and interest will be paid on the date of pre-termination but the interest rate is based on the prevailing regular savings interest rates.

Bank’s rates may be changed daily, please contact the Bank for more information on our current interest rates offered.

Our Achievements

Achieve More: Discover Loans for Every Need

Empowering Filipino Farmers and Fisherfolk!

AgriLife is here to help you cultivate your success! We offer a range of flexible loans designed to meet the diverse needs of farmers.

LifeDRIVE: Get Behind the Wheel of Your Dreams!

LifeDRIVE is your one-stop shop for financing the vehicle you need to achieve your goals. Whether you’re a farmer, entrepreneur, or everyday driver

LifeHOME: Your Key to Unlocking Your Dream Home

LifeHOME provides a comprehensive loan solution to turn your dream of owning a home into reality. Whether you’re purchasing a lot, building new, or renovating your existing space.

Get the Financial Freedom with Life Flexi Loan

Life Flexi Loan is a convenient and adaptable loan solution designed to meet your individual needs. Whether you require a secured or unsecured loan.

LifeSavers Loan: Your Safety Net

Existing Special Savings holders can access this on-demand loan for unexpected expenses. LifeSavers Loan helps you bridge financial gaps for unplanned costs, protecting your savings goals.

Support Your Business Growth: Life Negosyo Loans

This option keeps the core message while removing unnecessary details. “Support” implies financial assistance, and “Growth” emphasizes the benefit to businesses.

HOW TO APPLY FOR A LOAN?

Ready to see if you qualify? Check your eligibility for a loan in just a few steps

Step 1: Choose the loan product you would like to apply for

Step 2: Determine if you are eligible to apply by checking the qualifications and requiremetns

Step 3: Download the application form

Step 4: Fill out the form and meet the requirements

Step 5: Visit the nearest LifeBank – A Rural Bank branch near you

Step 6: Complete the next steps outlined by your loan assistant

Loan calculator

Discover low interest rates and easy payment terms for your home, auto, and SME financing needs.

Stay Tuned! Exciting Ways to Bank at Your Fingertips!

Manage your finances anytime, anywhere with our revolutionary mobile banking app – coming soon! Check account balances, transfer funds, and deposit checks with just a few taps. Our secure and user-friendly platform puts the power of banking in the palm of your hand!

SDID: Shaping a Sustainable Tomorrow

Grow Your Business: LifeSMILE Loans

Support your micro, small, or medium enterprise with LifeSMILE loans. Get financing for equipment, inventory, or expansion. We offer credit lines, working capital, and fixed asset financing.

Empower Your Future: Ikabuhi Microloans

Launch or grow your business with Ikabuhi. Microloans for enterprising men & women in Iloilo City. Includes savings & insurance for a secure future.

Invest in Your Wellbeing: Wash Loans

New Wash Loans! Improve your health with financing for water, sanitation, and hygiene projects. Available for our SDID clients in Iloilo City.

Support Their Dreams: Educational Loans

Help your child reach their full potential with an Educational Loan. Available for qualified SDID clients in Iloilo City. We empower their future education.

Empower through Ikabuhi Entrepreneurial Program

Build your business with Ikabuhi Entrepreneurial Program. Loans, savings & insurance for Iloilo City entrepreneurs. Secure your financial future, step-by-step.

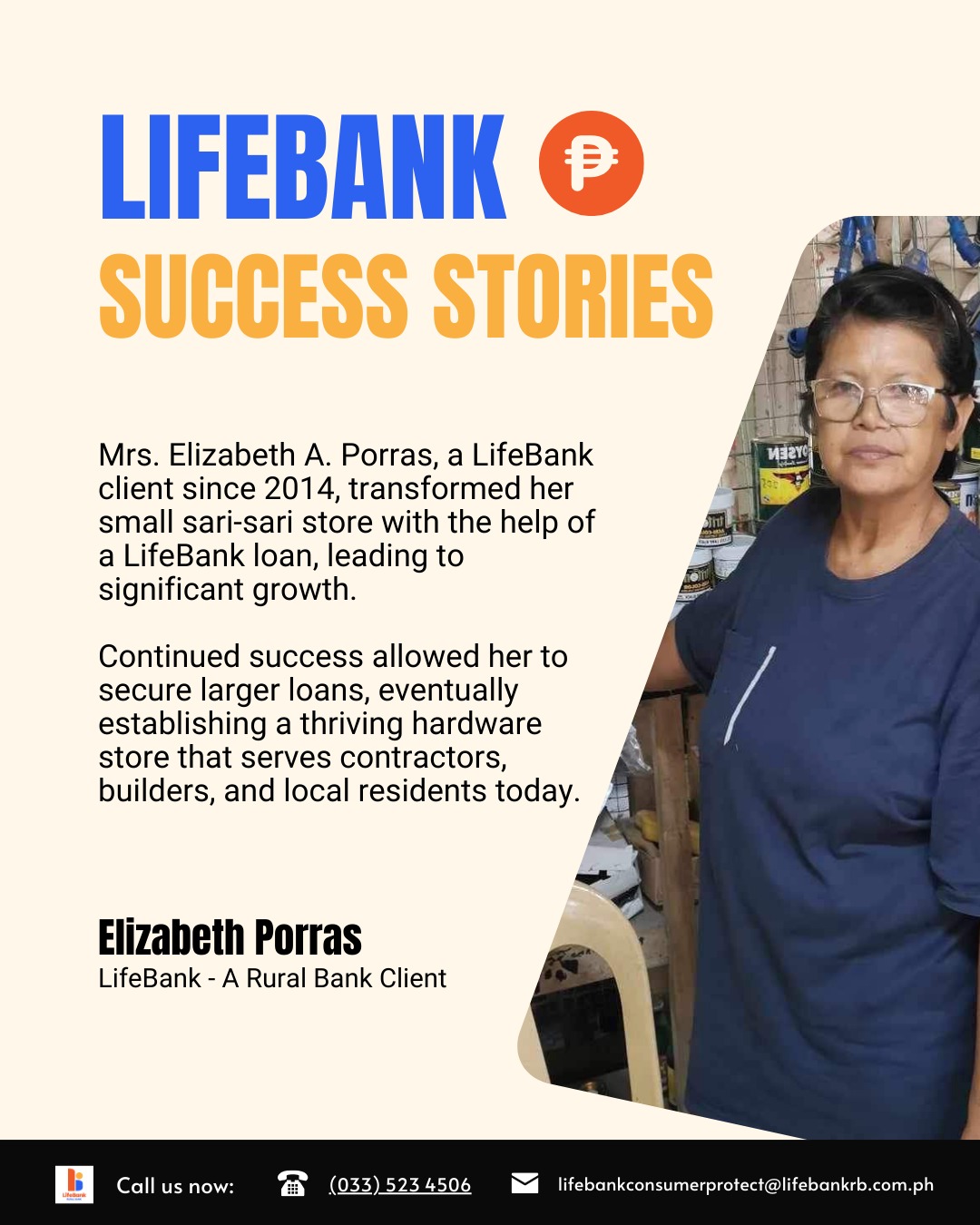

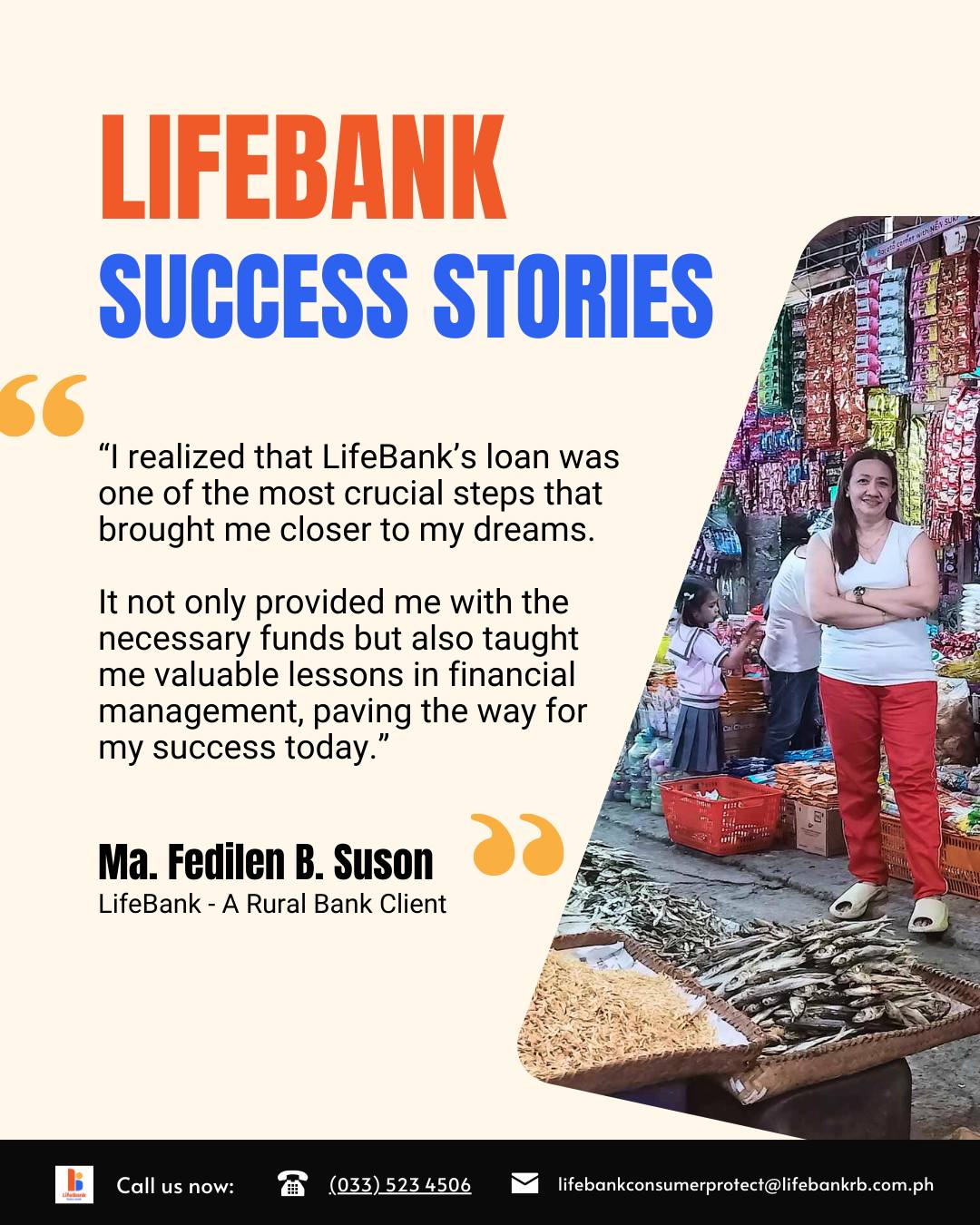

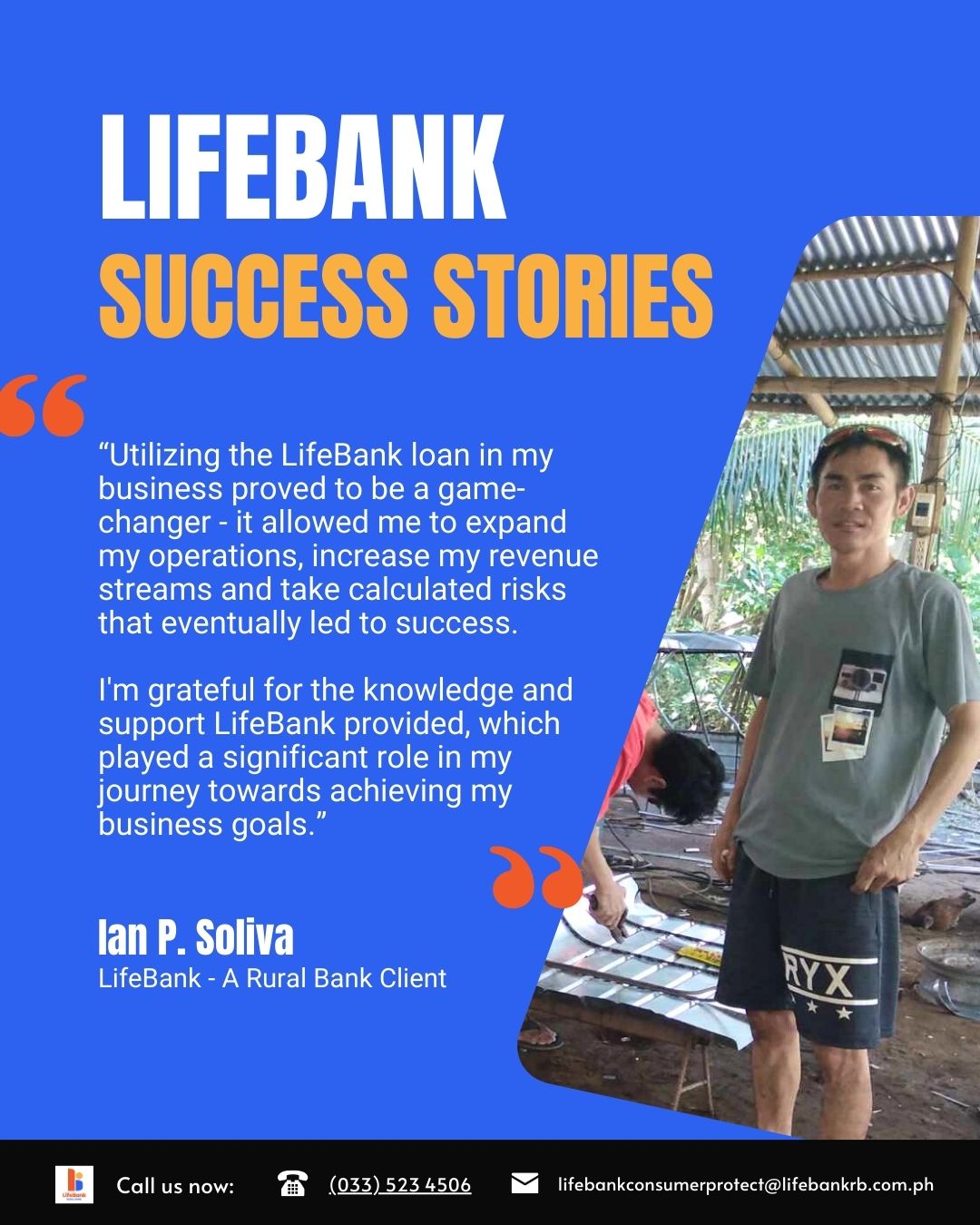

LifeBank Success Stories

News and Advisory

Need Assistance? Contact Us Today

Get the answers you need quickly and easily. We’re always happy to help.